掌握 NumPy 常用函数 II

斐波那契数的第 n 项

import numpy as np

phi = (1 + np.sqrt(5))/2

print("Phi", phi)

n = np.log(4 * 10 ** 6 * np.sqrt(5) + 0.5)/np.log(phi)

print(n)

n = np.arange(1, n)

print(n)

fib = (phi**n - (-1/phi)**n)/np.sqrt(5)

print("First 9 Fibonacci Numbers", fib[:9])

fib = fib.astype(int)

print("Integers", fib)

'''

Integers [ 1 1 2 3 5 8 13 21 34

... snip ... snip ...

317811 514229 832040 1346269 2178309 3524578]

'''

eventerms = fib[fib % 2 == 0]

print(eventerms)

print(eventerms.sum())

寻找质因数

from __future__ import print_function

import numpy as np

N = 600851475143

LIM = 10 ** 6

def factor(n):

a = np.ceil(np.sqrt(n))

lim = min(n, LIM)

a = np.arange(a, a + lim)

b2 = a ** 2 - n

fractions = np.modf(np.sqrt(b2))[0]

indices = np.where(fractions == 0)

a = np.ravel(np.take(a, indices))[0]

a = int(a)

b = np.sqrt(a ** 2 - n)

b = int(b)

c = a + b

d = a - b

if c == 1 or d == 1:

return

print(c, d)

factor(c)

factor(d)

factor(N)

'''

1234169 486847

1471 839

6857 71

'''

寻找回文数

# 来源:NumPy Cookbook 2e Ch3.3

# 回文数正着读还是反着读都一样

# 由两个两位数的乘积构成的最大回文数是 9009 = 91 x 99

# 寻找两个三位数乘积构成的最大回文数

# 1. 创建三位数的数组

a = np.arange(100, 1000)

np.testing.assert_equal(100, a[0]) np.testing.assert_equal(999, a[-1])

# 2. 创建两个数组中元素的乘积

# outer 计算数组的外积,也就是 a[i] x a[j] 的矩阵

# ravel 将其展开之后,就是每个元素乘积的数组了

numbers = np.outer(a, a)

numbers = np.ravel(numbers)

numbers.sort()

np.testing.assert_equal(810000, len(numbers))

np.testing.assert_equal(10000, numbers[0])

np.testing.assert_equal(998001, numbers[-1])

#3. 寻找最大的回文数

for number in numbers[::-1]:

s = str(numbers[i])

if s == s[::-1]:

print(s)

break

稳态向量

from __future__ import print_function

from matplotlib.finance import quotes_historical_yahoo

from datetime import date

import numpy as np

today = date.today()

start = (today.year - 1, today.month, today.day)

quotes = quotes_historical_yahoo('AAPL', start, today)

close = [q[4] for q in quotes]

states = np.sign(np.diff(close))

NDIM = 3

SM = np.zeros((NDIM, NDIM))

signs = [-1, 0, 1]

k = 1

for i, signi in enumerate(signs):

start_indices = np.where(states[:-1] == signi)[0]

N = len(start_indices) + k * NDIM

if N == 0:

continue

end_values = states[start_indices + 1]

for j, signj in enumerate(signs):

occurrences = len(end_values[end_values == signj])

SM[i][j] = (occurrences + k)/float(N)

print(SM)

'''

[[ 0.5047619 0.00952381 0.48571429]

[ 0.33333333 0.33333333 0.33333333]

[ 0.33774834 0.00662252 0.65562914]]

'''

eig_out = np.linalg.eig(SM)

print(eig_out)

'''

(array([ 1. , 0.16709381, 0.32663057]),

array([[ 5.77350269e-01, 7.31108409e-01, 7.90138877e-04],

[ 5.77350269e-01, -4.65117036e-01, -9.99813147e-01],

[ 5.77350269e-01, -4.99145907e-01, 1.93144030e-02]]))

'''

idx_vec = np.where(np.abs(eig_out[0] - 1) < 0.1)

print("Index eigenvalue 1", idx_vec)

x = eig_out[1][:,idx_vec].flatten()

print("Steady state vector", x)

print("Check", np.dot(SM, x))

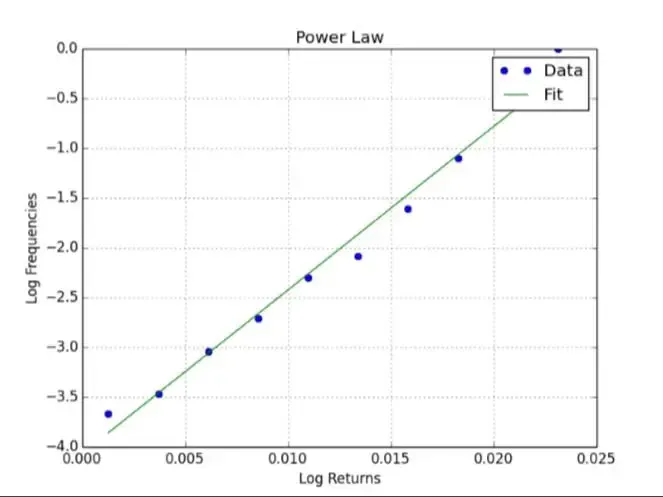

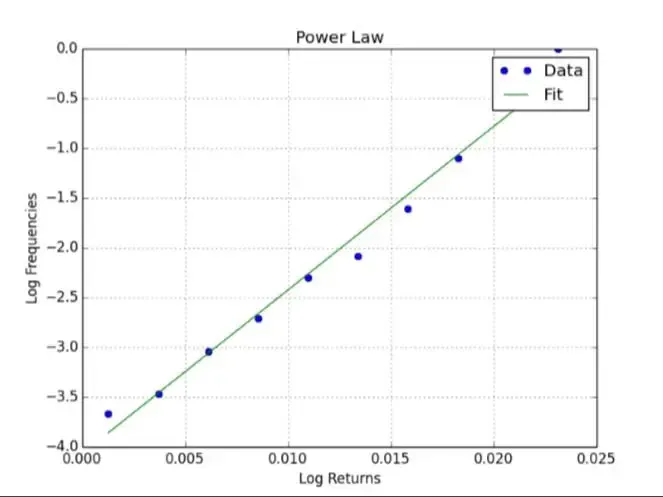

探索幂率

# 来源:NumPy Cookbook 2e Ch3.5

# 幂律就是 y = c * x ** k 的函数关系

from matplotlib.finance import quotes_historical_yahoo

from datetime import date

import numpy as np

import matplotlib.pyplot as plt

# 1. 获取收盘价

today = date.today()

start = (today.year - 1, today.month, today.day)

quotes = quotes_historical_yahoo('IBM', start, today)

close = np.array([q[4] for q in quotes])

# 2. 获取正的对数收益

logreturns = np.diff(np.log(close))

pos = logreturns[logreturns > 0]

# 3. 获取收益频率

# histogram 默认将输入数据分为 10 个组

# 返回一个元组,第一项是每个组的频数

# 第二项是每个组的范围

counts, rets = np.histogram(pos)

# 取每个组的中间值

rets = rets[:-1] + (rets[1] - rets[0])/2

# 计算频数非 0 的位置

indices0 = np.where(counts != 0)

# 过滤掉频数为 0 的数据点

counts = np.take(counts, indices0)[0]

rets = np.take(rets, indices0)[0]

# 计算对数周期

freqs = 1.0/counts

freqs = np.log(freqs)

# 4. 将周期和收益拟合为直线

p = np.polyfit(rets,freqs, 1)

# 5. 绘制结果

plt.title('Power Law')

plt.plot(rets, freqs, 'o', label='Data')

plt.plot(rets, p[0] * rets + p[1], label='Fit')

plt.xlabel('Log Returns')

plt.ylabel('Log Frequencies')

plt.legend()

plt.grid()

plt.show()

# log(T) = k * log(R) + c

# T = exp(c) * R ** k

# 满足幂率关系

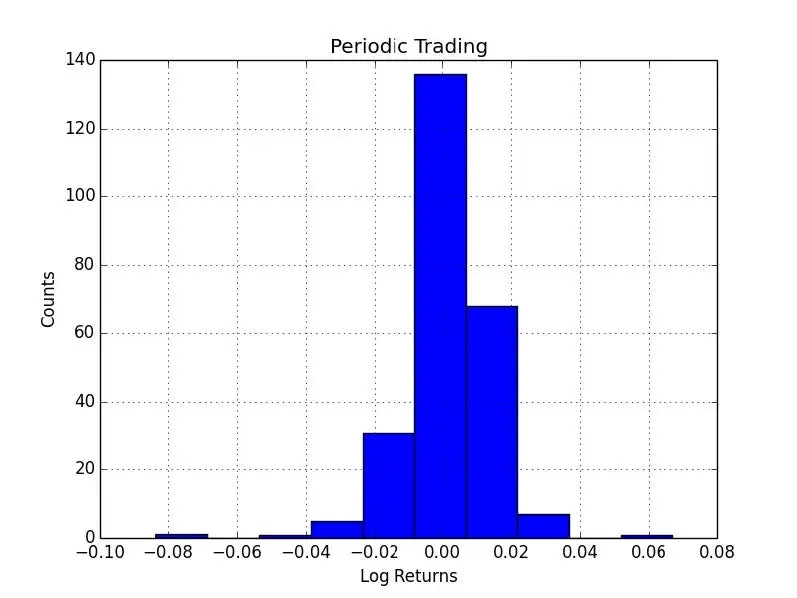

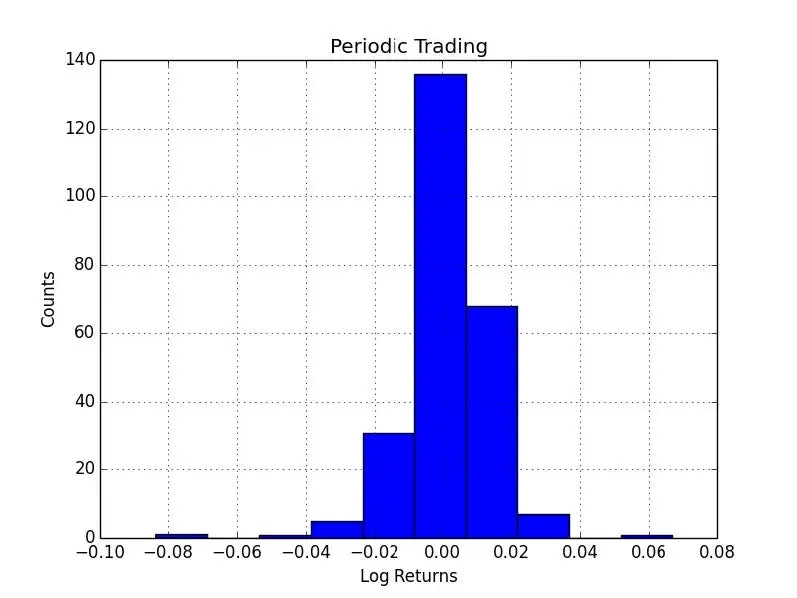

收益的分布

from __future__ import print_function

from matplotlib.finance

import quotes_historical_yahoo

from datetime import date

import numpy as np

import scipy.stats

import matplotlib.pyplot as plt

today = date.today()

start = (today.year - 1, today.month, today.day)

quotes = quotes_historical_yahoo('AAPL', start, today)

close = np.array([q[4] for q in quotes])

logreturns = np.diff(np.log(close))

freq = 0.02

breakout = scipy.stats.scoreatpercentile(logreturns, 100 * (1 - freq) )

pullback = scipy.stats.scoreatpercentile(logreturns, 100 * freq)

buys = np.compress(logreturns < pullback, close)

sells = np.compress(logreturns > breakout, close)

print(buys)

print(sells)

print(len(buys), len(sells))

print(sells.sum() - buys.sum())

plt.title('Periodic Trading')

plt.hist(logreturns)

plt.grid()

plt.xlabel('Log Returns')

plt.ylabel('Counts')

plt.show()

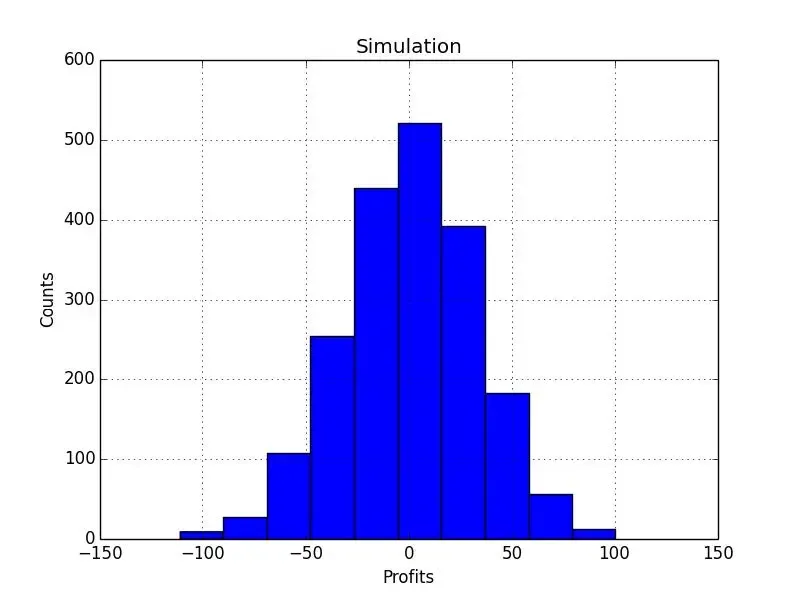

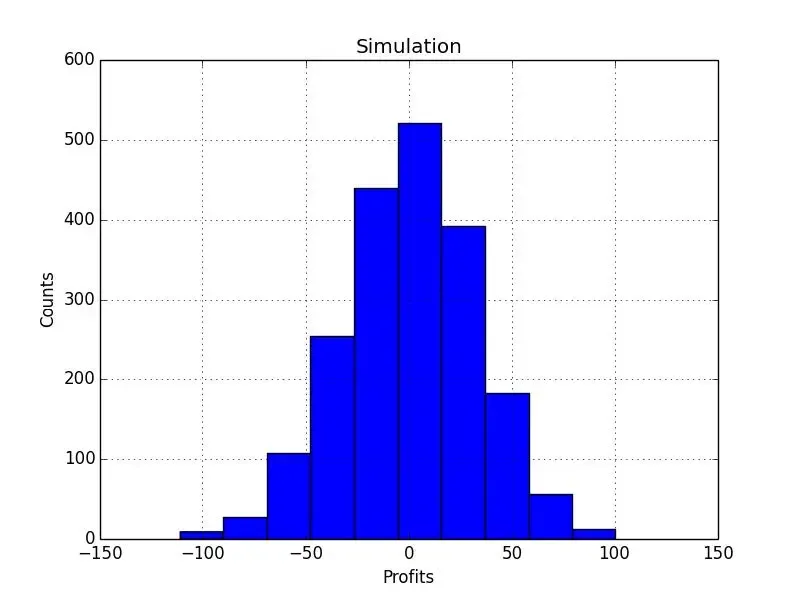

模拟随机交易

from __future__ import print_function

from matplotlib.finance import quotes_historical_yahoo

from datetime import date

import numpy as np

import matplotlib.pyplot as plt

def get_indices(high, size):

return np.random.randint(0, high, size)

today = date.today()

start = (today.year - 1, today.month, today.day)

quotes = quotes_historical_yahoo('AAPL', start, today)

close = np.array([q[4] for q in quotes])

nbuys = 5

N = 2000

profits = np.zeros(N)

for i in xrange(N):

buys = np.take(close, get_indices(len(close), nbuys))

sells = np.take(close, get_indices(len(close), nbuys))

profits[i] = sells.sum() - buys.sum()

print("Mean", profits.mean())

print("Std", profits.std())

plt.title('Simulation')

plt.hist(profits)

plt.xlabel('Profits')

plt.ylabel('Counts')

plt.grid()

plt.show()

埃拉托色尼筛选法

from __future__ import print_function

import numpy as np

LIM = 10 ** 6

N = 10 ** 9

P = 10001

primes = []

p = 2

def sieve_primes(a, p):

a = a[a % p != 0]

return a

for i in xrange(3, N, LIM):

a = np.arange(i, i + LIM, 2)

while len(primes) < P:

a = sieve_primes(a, p)

primes.append(p)

p = a[0]

print(len(primes), primes[P-1])